SPONSORSHIP & PROMOTIONAL OPPORTUNITIES

Over the years, Climate Bonds events have become pivotal for discussions about how the debt capital markets finance climate change. Through solid relationships forged with green issuers and investors worldwide, Climate Bonds facilitates engagement between the private and public sectors, aligning efforts and initiatives. Our Climate Bonds CONNECT events provide the ideal opportunity to network and showcase your organisation's services and products to a targeted audience of asset owners, issuers, investors, financial leaders and policymakers from across the globe.

Become a Sponsor

|

Benefit from brand association Associating with an independent, authoritative and internationally recognised organisation such as Climate Bonds Initiative adds gravitas and credibility to your brand and what you do.

Demonstrate market leadership Galvanise your position as a market leader, drive innovation, and stay ahead of future regulation that may impact your business.

Commit to change Act on the climate crisis, which is an existential threat to communities and companies in all corners of the globe and advance sustainability by understanding how best to commit your budget to green.

Showcase your products and services Use our events to showcase your unique products and services in the realm of sustainable finance.

Expand your network and reach Benefit from our expansive list of over 3000+ registration contacts. |

|

The Audience

|

|

OUR ATTENDEE LIST FROM LONDON CONNECT 2023 INCLUDED

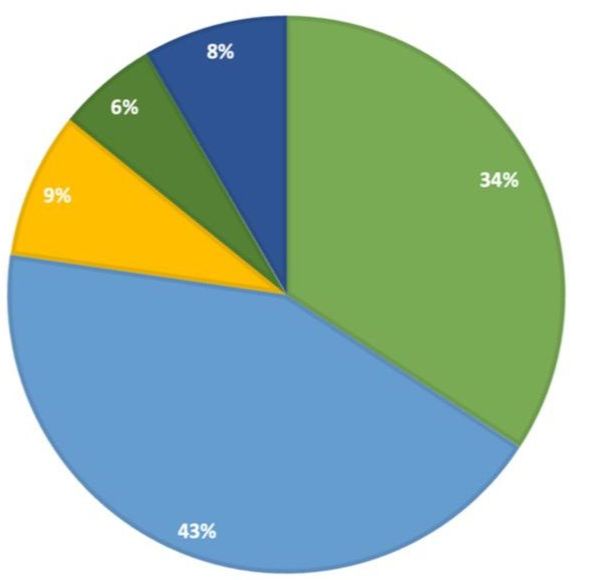

34% - Directors, Founders, CEOs, Board Members, Heads, Government, and Partners 43% - Economists, Investment Specialists, Managers, Advisors, Senior Analysts, Consultant and Coordinators 9% - Technical Specialists, Engineers, Principals, Product Professionals 6% - Professors, Researchers and Academics 8% - Other |

|

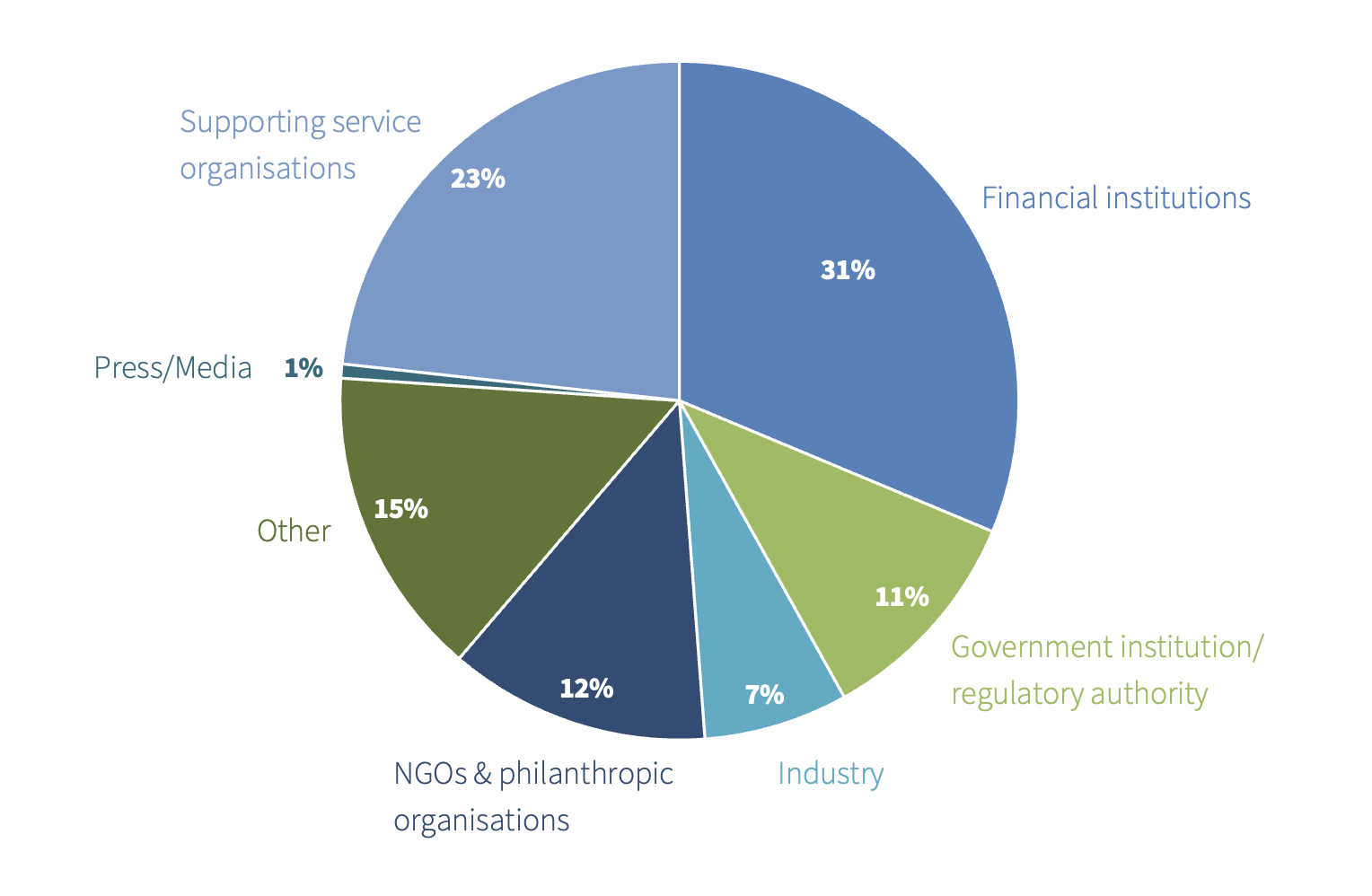

WHO DO WE EXPECT AT CONNECT 2024? In 2024, we anticipate a diverse audience, mirroring that of 2023. This includes participants from financial institutions (31%, encompassing corporate, development, central, investment, private banks, pension funds, sovereign wealth funds, and underwriters), supporting service organizations (23%, such as law and accounting firms, consultancies, and external review service providers), NGOs (12%), government institutions, and regulatory authorities (11%), along with industry members (7%). |

|

|

|

If you are interested in partnership opportunities for any one of our events, please use the form below to contact us to discuss available options or contact Alicia Bastos von Dollinger, Global Head of Events at Climate Bonds Initiative