|

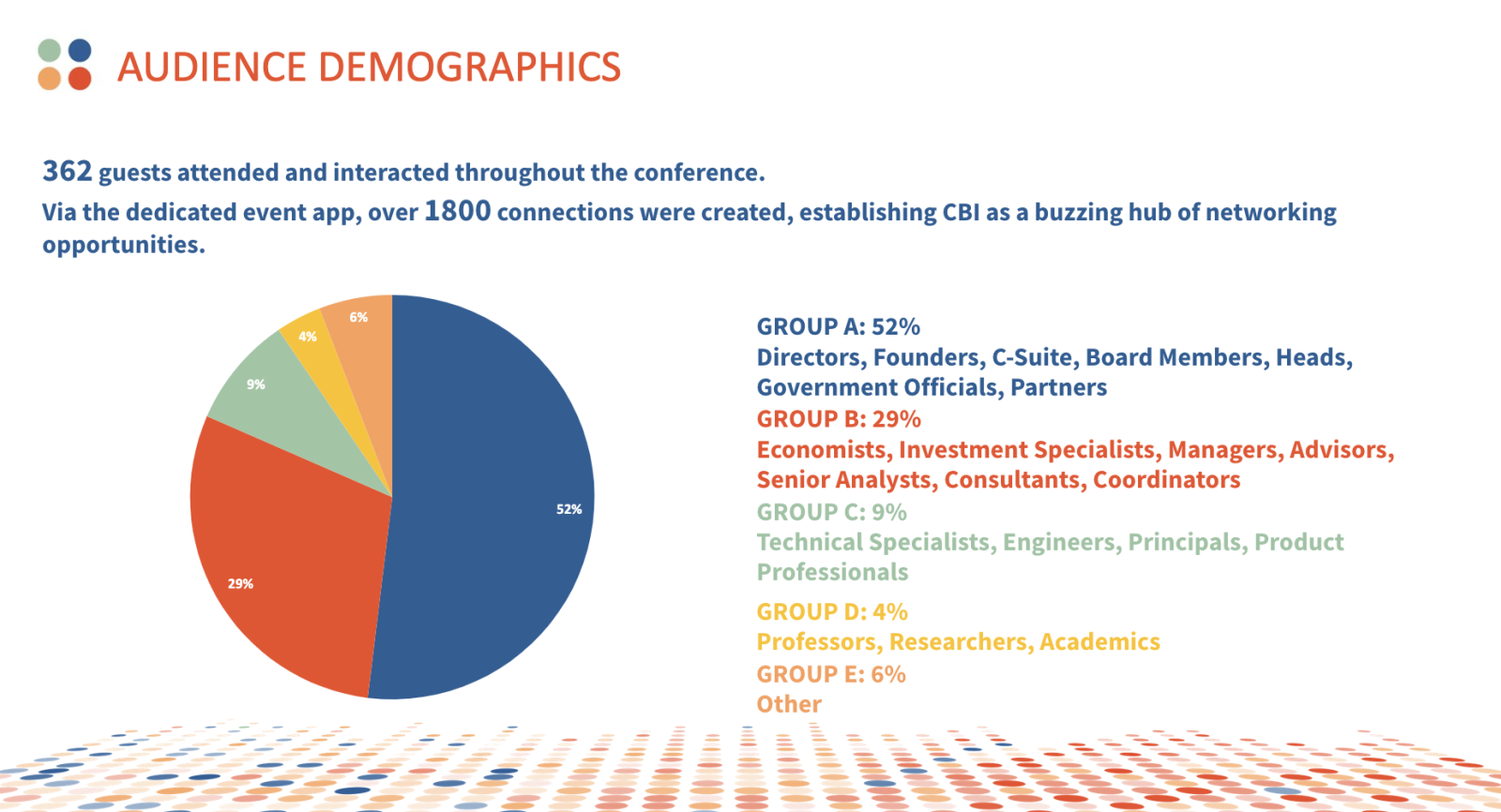

Climate Bonds hosted the first Climate Bonds Connect 2023 regional seminar in Hong Kong. Bringing together key decision-makers and top-tier influencers, the event demonstrated the growing appetite for sustainable finance in the region and the tremendous opportunity for investors looking to finance the road to net zero. The seminar's theme, “Ready, Set, Transition” highlighted the importance of a credible transition to a green future. Industries with high carbon emissions in particular must undergo a comprehensive overhaul of their strategies. Climate Bonds Connect centers around facilitating a credible brown-to-green global transition that is ambitious, inclusive, and aligned with the Paris Agreement. During the event, regulators, investors, asset managers, and influencers discussed their views on developing a sustainable market and how credible, ambitious efforts to decarbonise the Chinese economy can help the country reach its climate targets. One of the key takeaways was the acknowledgment of the increase of climate finance in the public discourse in the region. The quality and quantity of attendees and participants was a testament to the growing appetite for credible transition planning in Asia. Read the blog for this event here. |

.jpg)

|

Testimonials

|

|

"So far, we've been seeing a lot of debt related instruments such as sustainability-linked bonds and loans, but we also need a lot more equity and insurance-like products. The key thing that G20 said is, in fact, we need to build the incentive in the products to encourage the company to decarbonise as much as possible. Some sort of awards and penalties for performance and performance, we will be building and the fourth pillar." "The government needs to be pressured so they can move faster. The government needs to be equipped with private sector resources and you know, all these things require a better form of private public sector partnership." |

|

|

"The Greater Bay area clearly is an area of huge economic science. We have Shenzhen and we have Hong Kong, basically a good combination of both technology as well as finance. That could potentially drive the whole green transition in mainland China. What we've been using the Greater Bay Area to do is to experiment and set examples. For instance, we know that a lot of the financing in mainland China would have to come from international investment. We talked about the common ground taxonomy, but we also want to bring issuers to Hong Kong to make sure that they can tap into international capital. So, over the past few years, we've seen notably the Shenzhen government coming to Hong Kong issuing green bonds, issuing sustainable bonds, tapping into that market."

|

|

|

"What has driven the transition in Japan is, in a nutshell, nudging and peer pressure. When the EU taxonomy came out, it was alarming to METI recognising that there should be more orderly thinking to accelerate peer pressure towards transition. So, this transition finance framework was developed and benchmarked on a METI technology roadmap on how power and hard-to-abate industries are expected to transit in terms of technologies." |

| See more testimonials here. |