|

| WATCH RECORDING | SPEAKERS | SPONSORS | |

Climate Bonds CONNECT: North America Regional Seminar - 8 December 2022

Hybrid event

Our North America Regional Seminar took place in New York where local actors, including investors and regulators, convened to discuss the region’s priorities to accelerate the development of the sustainable debt market and explore opportunities by which we can mobilise $5trillion per year by 2025.

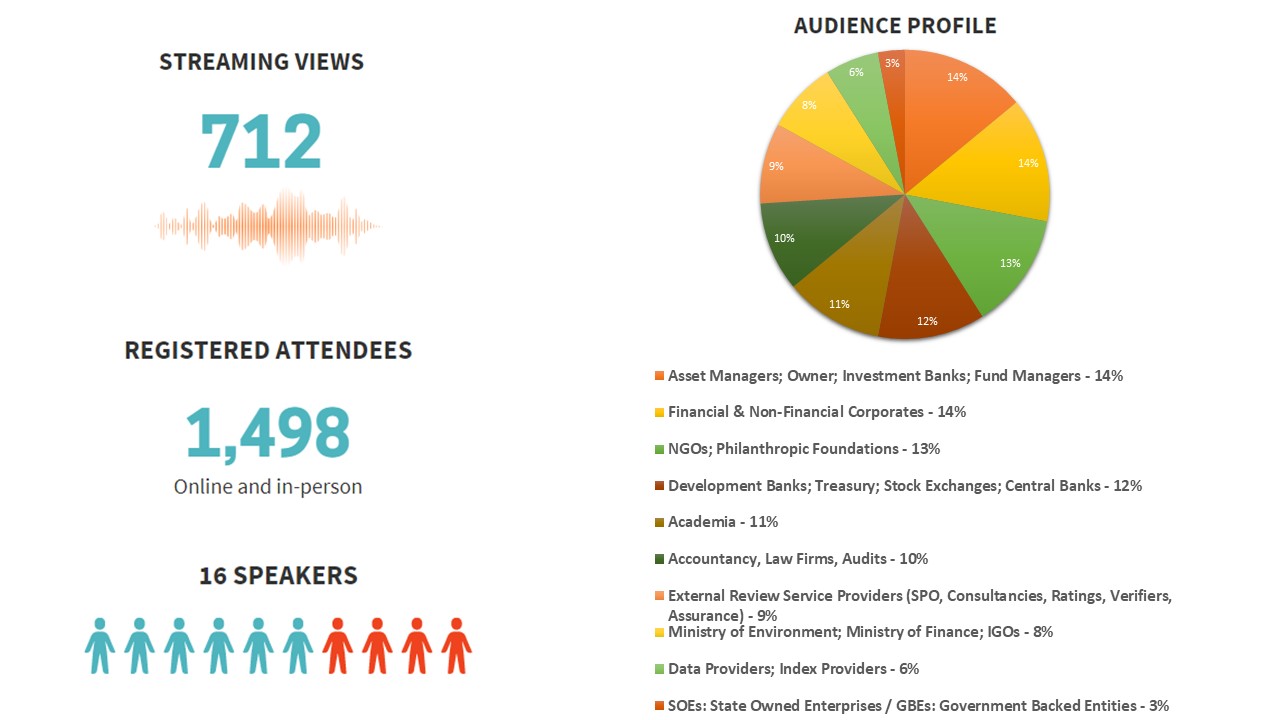

With a mix of invitation only in-person participation and a larger online audience, the event connected a wide audience to the discussions.

WATCH THE SESSION RECORDINGS HERE

North America Regional Seminar Highlights

SPONSORS

Event Gallery